- Home

Blog Why invest in Balanced Advantage Funds in these market conditions

31 January 2023

Why invest in Balanced Advantage Funds in these market conditions

Balanced advantage funds, also known as dynamic asset allocation funds, are a type of hybrid mutual funds which invests in debt, equity and arbitrage strategies. The asset allocation of these funds is managed dynamically based on an asset allocation model that changes asset allocation depending on market conditions. SEBI has not mandated upper or lower asset allocation limits for balanced advantage funds. In this article, we will discuss the benefits which balanced advantage funds will bring to your investment portfolio.

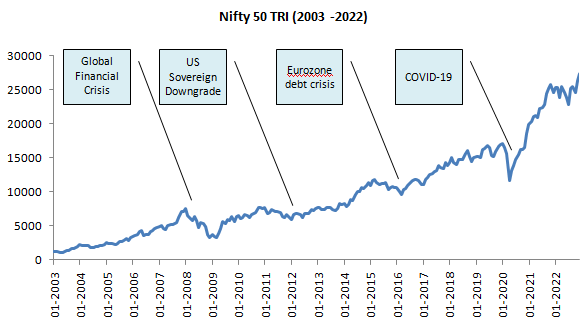

Market cycles are inevitable

Equity as an asset class has wealth creation potential in the long term, but equity markets are subject to business cycles – there will be periods of rising and falling markets (see the last 20 years chart of Nifty 50 TRI below). In rising markets, valuations keep increasing till we reach a point where valuations become very expensive. When correction comes, we see sell-off from and prices come down, till we get to a point where valuations start becoming attractive. At this point of time, the market bottoms out and market starts rising again. This cycle keeps repeating over and over again.

Source: National Stock Exchange, Advisorkhoj Research. Period: 1st January 2003 to 31st December 2022. Disclaimer: Past performance may or may not be sustained in the future

What should investors do in market cycles?

You can take advantage of market cycles by buying when valuations are cheap and selling when valuations are expensive. This is the age old investment wisdom of “Buy low and sell high”. However, investors do exactly the opposite. Mutual fund flow data shows inflows when valuations are expensive is nearly 3 times that of inflows when valuations are reasonable or low. This is due behavioural bias which investors have. The behavioural bias of greed and fear causes investors to buy high and sell low. In bull markets, investors think that the market will rise further and they keep buying even though prices are high. In bear markets, investors think that the market will fall further, so they sell in panic even though they should be buying because prices are low.

The legendary investor Warren Buffett said, “Successful Investing takes time, discipline and patience”. Discipline is very important in investing. As Buffett said, “The most important quality for an investor is temperament, not intellect”; in other words, you need to be in control of your emotions. However, this is easier said than done, since the history of equity markets have shown that the stock prices overheating and then correcting and the cycle keeps repeating over and over again. In order to take emotions our of investing one needs to have a model based approach to investing, where asset allocation models make investment decisions based on various factors.

Why invest in Balanced advantage Fund?

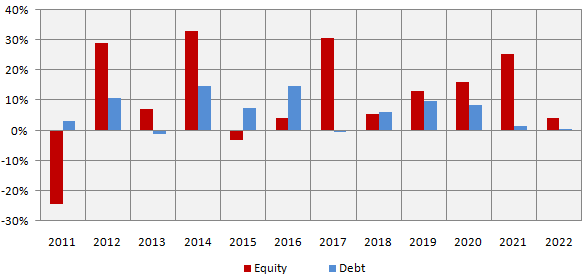

Balanced advantage funds solve the behavioural bias problem by taking emotions out of investing using a model based approach. Balanced advantage funds manage their asset allocation between debt and equity using a dynamic asset allocation model. There is low correlation of returns between debt and equity (see the chart below). By dynamically managing asset allocation between debt and equity, balanced advantage funds can reduce downside risk and bring stability to your portfolio.

Source: National Stock Exchange, Advisorkhoj Research. Period: 1st January 2003 to 31st December 2022. Equity is represented by Nifty 50 TRI and debt by Nifty 10 year benchmark G-Sec index. Disclaimer: Past performance may or may not be sustained in the future

The dynamic asset allocation model of a balanced advantage changes asset allocation to equity and debt based on various factors like valuations, market sentiments, earnings outlook etc. A counter-cyclical balanced advantage fund may reduce its equity allocations and increase its debt allocations as equity valuations increase. When equity valuation decreases, the fund may increase its equity allocation and reduce its fixed income allocation. In other words, the balanced advantage fund is buying low and selling high. You can see that balanced advantage fund, not only reduces downside risks, brings stability to your portfolio, but it can also generate risk adjusted returns for investors. However, in order to get capital appreciation from risk adjusted returns you need to remain invested across several market cycles.

Why you need long investment tenures for balanced advantage funds?

A balanced advantage fund will have lower allocations to equity when valuations are high. Hence returns will be relatively lower in bull markets compared to funds where equity valuations are high. However, you will experience smaller drawdowns (downside risk) in bear markets. In bear market, the fund will increase its equity allocation and you will see the benefits of the dynamic asset allocation strategy when the market bottoms out and bull market resumes. Therefore, it is important to remain invested across multiple market cycles to get the benefit of balanced advantage fund. In our view, you should have an investment horizon of 5 years or longer for balanced advantage funds.

Why balanced advantage funds make sense now?

Over the past 2 years, inflation has been high globally. This is partly due to huge amount of liquidity pumped into the financial system by central banks in response to the COVID-19 pandemic. Another cause of high inflation is the supply chain disruptions caused by the pandemic and lockdown. Russia’s invasion of Ukraine in 2022 and ensuing sanctions have aggravated the inflation. Central banks like the US Fed and our RBI responded by hiking interest rates. Interest rate hikes and high inflation have caused economic headwinds. Europe is in recession and there is a chance that the US economy may also go into a recession in 2023.

At the same time, global inflation has been stubborn and so we may have to remain in a high interest rate environment for a longer period of time than earlier anticipated. High valuation of Indian equities is another cause of concern, at a time when we face economic headwinds due to global economic conditions. As such, there is uncertainty about short term market outlook. In changing times, balanced advantage funds which manage asset allocation dynamically with changing market conditions may be suitable for investors.

About SBI Balanced Advantage Funds

Dynamic asset allocation strategy

Asset allocation of SBI Balanced Advantage Fund at any given point of time will be determined by the fund managers using the following parameters:-

- Sentiments Indicator – breadth of the market, retail participation, mutual fund flows, primary market activities etc

- Valuations – various valuation metrics like trailing PE multiple, Shiller’s PE (which uses 10 year inflation adjusted EPS in PE calculation), earnings yield (inverse of PE ratio), equity valuations relative debt valuations and bond yield spreads (spreads of corporate bonds over G-Secs)

- Earnings drivers – fiscal / monetary positions, real rates, monetary policy framework, variables of off-shore market.

Stock / security selection

- Strategy tilt in terms of market cap and growth / value stocks is determined using an objective framework

- Stock picking is based on fund manager conviction and highest conviction ideas of the analyst team

- In the debt portfolio, the fund invests in high credit quality and Sovereign debt and money market instruments

- The fund manager of the debt portfolio actively manages duration based on interest rate outlook

Why invest in SBI Balanced Advantage Funds?

- Diversification across asset classes to balance the risk & reward

- Dynamically managed Asset Allocation basis the market outlook

- Uniqueness of the asset allocation range i.e. from 0%-100% for both debt & equity

- Managed by expert fund managers

- Suitable for new investors or investors who do not have high risk appetites

- Benefits of equity taxation

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.